NYC Solar Property Tax Abatement PTA4 Explained [UPDATED for 2023]

We are once again approaching the March 15th deadline for the 2023 New York Property Tax Abatement Application for Solar Electric Generating System (PTA4 form)! This tax abatement is a great way for commercial and residential business owners to install solar panels and slowly receive a tax reduction to cover some of the cost. But there are some very real pitfalls and misunderstandings that solar developers need to be aware of in order to properly set their customer’s expectations.

Below, we answer some of the most common questions. To make sure your clients receive this incentive, we also added some tips to help complete the NYC Department of Buildings (DOB) Property Tax Abatement Application (PTA4).

What is the NYC Solar Property Tax Abatement Incentive?

The NYC property tax abatement incentive is a program designed to encourage property owners to install solar PV systems for distributed electricity generation. The program allows property owners to deduct 5% of the cost of a solar installation each year, for four consecutive years, from property tax bills up to $62,500.00.

This incentive is a big help in offsetting 20% of the cost of solar systems. However, it is only available on new systems placed in service by January 1, 2024.

What installation costs are eligible for the NYC Solar Property Tax Abatement?

Property owners get the property tax abatement incentive based on the total installation cost. Total installation costs include all solar PV equipment, installation labor, and system design costs. Any rebates the customer received must be subtracted from the total cost.

Are property owners still eligible for other NY State and Federal solar incentives?

Yes. Property owners are still eligible for New York State and Federal Income Tax Credits. In addition, property owners are eligible for a rebate from NYSERDA. It’s important to note though, as stated above, that any NYSERDA rebates must be deducted from the total cost of the solar installation before applying for the NYC Property Tax Abatement.

What forms need to be completed?

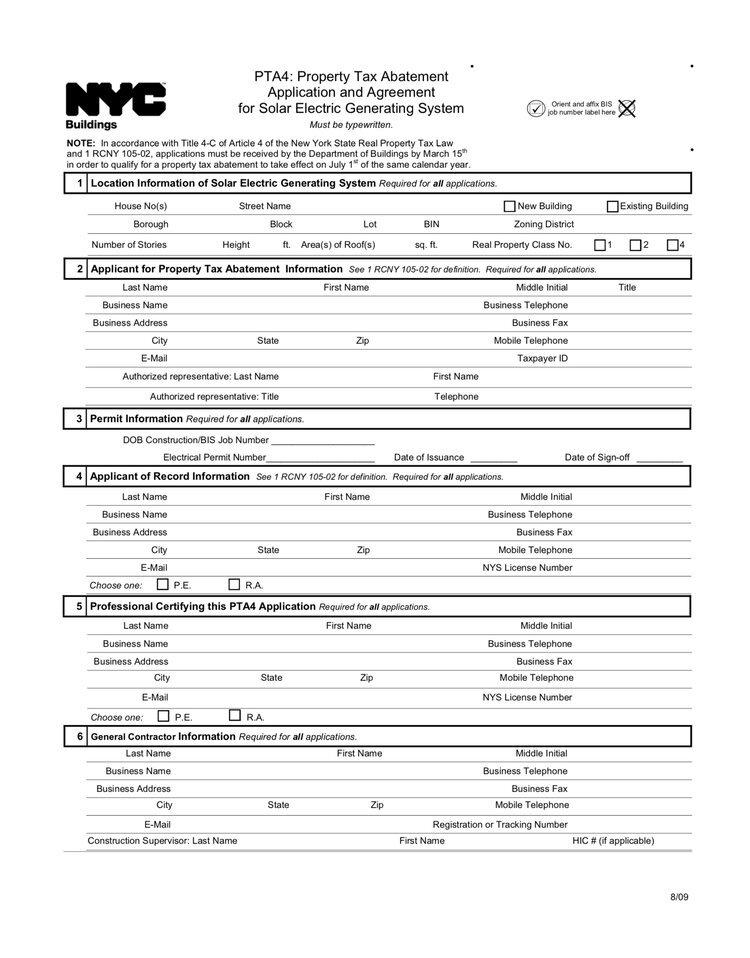

Form PTA4: Property Tax Abatement Application and Agreement for Solar Electric Generating System needs to be completed to apply for this incentive. You can find it on the NYC DOB’s website here.

How can you make sure Form PTA4 is completed right the first time?

We have three tips for filling out Form PTA4 correctly:

1. Pay attention to Question #8: Solar System Place in Service Date.

This is the question that is most often answered incorrectly, and the wrong answer means that an application will be rejected and require corrections. Since a delay can result in losing out on the Property Tax Abatement until the following year, it’s really important to know which date to use.

The correct answer is either the date the system received permission to operate (PTO) or the date the electrical permit sign-off date. Whichever date is later is the one that should be listed.

2. Calculate your cost correctly.

Expenditures must be documented and remember, only certain expenditures apply. Just to make sure– only use equipment, labor, and design costs. And, don’t forget to deduct any rebates the owner received, (for example, the NYSERDA rebate), as the DOB accesses this information. Any errors here will most certainly get the application kicked back.

3. Submit the application by March 15.

All 2022 applications must be submitted by March 15 in order for the abatement to take effect on the July 1 tax bill of the same year. If submitted after March 15, the abatement won’t take effect until July 1 of the following year.

There is no wiggle room here. We realize it’s often not possible to submit the application before March 15, but it’s important to explain submission policies to your customers to properly set their expectations and curtail misunderstandings.

How can you ensure your customers apply for, and receive, every possible incentive?

You can partner with an expert in the bureaucratic side of NYC solar! We have decades of hard won expertise in the New York solar market and know about every potential hurdle you can face to submit your tax abatements. We can help you file for property tax abatements and have them seamlessly approved the first time. Take the guesswork out of the process for you and your customers.